Interested in trading cryptocurrencies or futures?

Those who are familiar with the concept of cryptocurrency trading know that it is a complex but fascinating market. However, everything depends not only on skill and a great deal of luck, but also on the proper tools, such as a trading terminal, a portfolio tracker, and a strategy.

What is a Good Cryptocurrency?

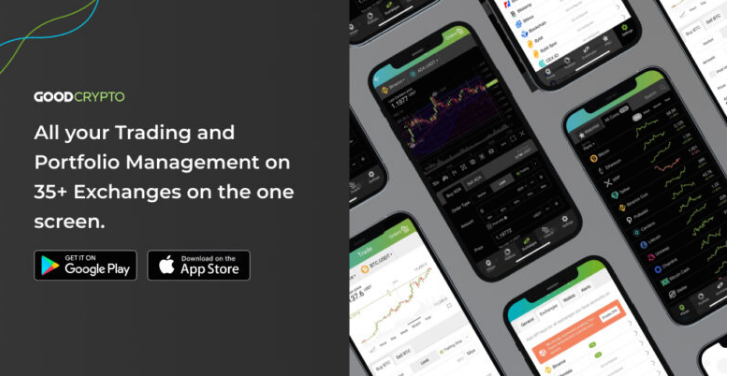

The Good Crypto app is a cutting-edge, all-inclusive trading and portfolio management app that gives its users access to an extensive range of the most desired tools that any successful trader or investor should have at their fingertips. GoodCrypto enables exploration of over 20,000 markets and trading on 35+ crypto exchanges from a single location, making successful trading possible at any time.

With trading bots from GoodCrypto, your portfolio will work for you no matter where you are, what you’re doing, or the trading strategy you choose. They assist in controlling emotions to prevent all possible trading errors.

- Infinity Trailing bot will help you automatically trade with the advanced GoodCrypto Trailing Stop orders, “catching” all market ups and downs, and making a profit in any market situation.

- Grid Bot places and maintains an automated grid of buy and sell limit orders of the same size, allowing you to catch the slightest profit opportunity, especially in the ranging market.

- DCA bot will help you to gain profit even in a bearish market by averaging the position and “pulling” the Take Profit order closer to the current price while maintaining a given level of profitability.

Key Features

- Advanced Trailing Stop orders will help you to easily enter and exit positions at better prices, which can bring you much more profit, especially if you follow the trend for as long as possible.

- Stop Loss and Take Profit Сombos. TP and SL can be attached to any order (market, limit, etc.) in one click, with no balance freeze, by using the GoodCrypto app. Stop Loss trigger will allow you to avoid premature exit from a position on short-term price spikes.

- Smart alerts about market conditions, new exchange listings, and potential DeFi gems on Uniswap and Pancakeswap will be available before they explode. Set up the Good Crypto alerts for price changes or pool liquidity to catch any profit opportunities.

- Portfolio Tracking: Track all your exchange accounts, blockchain wallets, trades and Using a bollinger bands strategy can help you make a profit by predicting a breakout in a short or middle period of time. However, you need to remember that the bands cannot tell you a final advantage of which direction a breakout will take. IBy properly using the indicator you can better adapt to market movements by following the BB corridor and mostly relying on the previous trend direction in trades.

- Depending on how price consolidates, rebounds or breaks the midline, we can get a sign of price intentions to move in a certain direction, or a weakening trend, or an upcoming exit from the range, by the behavior of the candles relative to the BB walls.

- By using BB paired with other indicators, such as a GoodCrypto market trend signals, the strategy multiplies the potential profit. transactions in one place in real time, on the screen of the GoodCrypto app.

- Smart TA signals. An advanced Technical Analysis rating for each coin, based on 13 Moving Averages and 4 Oscillators will show you when it’s better to buy or sell an asset.

How to Use a Bollinger Bands Strategy

Inside the GoodCrypto platform, there are numerous helpful tools for technical analysis; however, we will examine one of the most popular trading strategies based on the Bollinger Bands indicator. To enter a trade with your strategy, it is preferable to use multiple arguments or the technical analysis signals module within the application.

Using a bollinger bands strategy can help you generate a profit by predicting a short- or medium-term breakout. However, you must keep in mind that the bands cannot accurately predict the direction a breakout will take. By using the indicator correctly, you can better adapt your trading strategy to market movements by following the BB corridor and relying heavily on the direction of the previous trend in trades.

Guess it depends as to how value strengthens, rebounds, or breaks the midline of the criterion, the conduct of the tea lights relative to the BB walls can indicate price intentions to move in a certain direction, a weakening of the trend, or an upcoming exit from the range.

Using BB in conjunction with some other markers, such as GoodCrypto market trend signals, or utilizing the features and functions of GoodCrypto pending orders without freezing the balance, you will be able to place a large amount of setups in accordance with this strategy.

Breakouts

Utilize the Bollinger Bands strategy if you wish to trade at the start of trends. Typically, prices remain within the bands. But the breakout occurs when the asset price moves above the upper BB and below the lower BB. Traders look for a contraction in Bollinger Bands as this indicates a low volatility environment, it takes place before the breakout happens. After passing the bands’ contraction, volatility tends to increase.

To successfully trade breakouts, you must be patient, utilize precise trading tools, and comprehend market trends. Typically, breakouts are followed by a period of consolidation. Once price breaches the bands, it will likely reverse the direction of the intermediate-term trend. However, a long-term trend can change direction abruptly, so it is essential to be prepared to act immediately if the price breaks out. You can also use the RSI indicator to enhance your Bollinger Band signals or the technical analysis signals of the GoodCrypto platform. By utilizing additional confirmations, you can increase your winning trades and reduce your overall losses.

Utilizing Bollinger Bands as part of your trading strategy is a fantastic way to employ a variety of technical indicators. RSI indicates momentum around valuable price areas, whereas MACD is a potent indicator of trend strength. Regardless of the combination of trading strategies you employ, it is crucial that a platform like GoodCrypto provides advanced trading tools and simplifies your work in order to generate consistent profits.

Pricing

For only $9.99 per month, the GoodCrypto app provides you with all the advanced features, including the most desired trading bots.

Additionally, you can save money by subscribing to the annual plan, which costs only $79.99/year ($6.66/month).

Facilitated Exchanges

It does not charge trading fees in addition to those charged by exchanges.

GoodCrypto is compatible with 35+ leading cryptocurrency exchanges, including:

Binance, Coinbase Pro, Huobi, Mandala, Binance.US, Bitfinex, Bithumb, BitMart, MitMEX, Bitstamp, Bittrex, Blockchain, Bybit, Bybit Spot, CEX.io, Crypto.com, Exmo, FTX, FTX US, Gate.io, Gemini, HitBTC, Huobi, Huobi Futures, Indodax, Kraken, KuCoin, KuCoin Futures

Download Good Crypto from the iOS App Store, Android Play Store, or the web to make profitable trading available 24/7!

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  Stellar

Stellar  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Sui

Sui  WETH

WETH  Pepe

Pepe  LEO Token

LEO Token  Litecoin

Litecoin  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Dai

Dai  MANTRA

MANTRA  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Filecoin

Filecoin

Leave a Reply