First Quarter 2021 Financial Highlights:

- Income elevated 115% to a record of $583.8 million USD within the first quarter of 2021, in comparison with $271.4 million in the same year-ago quarter.

- Gross revenue elevated 91% to $53.5 million within the first quarter of 2021, in comparison with $28.0 million in the last year-ago quarter.

- Net earnings increased faster 3,348% to $4.8 million within the first quarter of 2021, in comparison with $0.1 million in the last year-ago quarter.

- Adjusted EBITDA (a non-GAAP financial measure) increased 159% to $14.8 million within the first quarter of 2021, in comparison with $5.7 million in the last year-ago quarter.

- Operating cash flow (a non-GAAP financial measure) increased 184% to $40.6 million within the first quarter of 2021, in comparison with $14.3 million in the last year-ago quarter.

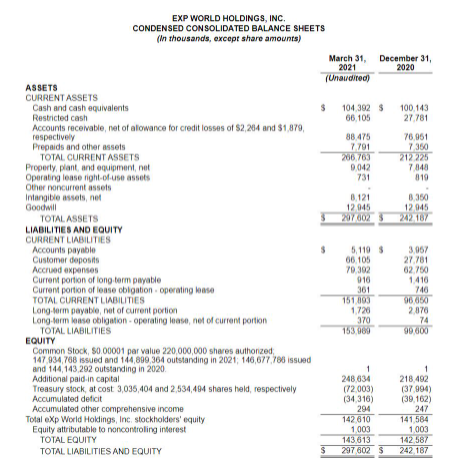

- As of March 31, 2021, cash and cash equivalents totaled $104.4 million, in comparison with $44.3 million as of March 31, 2020. The Firm repurchased roughly $34.0 million of frequent stock in the course of the first quarter of 2021.

Management Commentary

“As the quickest organically rising real estate brokerage on the planet, we’re making some considerable growth with gaining market share within the U.S.A and globally, having grown our agent base 77% year-over-year to exceed the 50,000-agent milestone within the quarter,” stated Glenn Sanford, Founder, Chairman, and CEO of eXp World Holdings. “Our document first quarter income and profitability is a direct end result of agents continuing to seek out success leveraging eXp Realty distinctive brokerage model and agent worth proposition.

First Quarter 2021 Operational Highlights:

- Brokers and Agents on the eXp Realty platform increased 77% to 50,333 at the end of the first quarter of 2021, in comparison with 28,449 at the end of the first quarter of 2020.

- Residential and business transaction sides closed elevated 95% to 73,878 within the first quarter of 2021, in comparison with 37,882 in the last year-ago quarter.

- Residential and business transaction volume closed elevated 123% to $24.5 billion within the first quarter of 2021, in comparison with $11.0 billion in the last year-ago quarter.

- eXp Realty expanded into 4 new international areas and territories within the first quarter of 2021, together with Puerto Rico, Brazil, Italy, and Hong Kong. Subsequent to the end of the first quarter, the Company efficiently launched in Colombia and publicly announced plans to establish operations in Spain and Israel by the end of the second quarter of 2021.

- eXp Realty ended the first quarter of 2021 with a 73 world Net Promoter rates, a measure of agent satisfaction, via the Company’s intense concentrate on agent expertise. This compares to a 70 world Net Promoter Rating at the end of the first quarter of 2020.

“the company substantial year-over-year will increase in income and cash flow generation has been pushed by industry-leading agent development and sustained transaction volume,” stated Jeff Whiteside, CFO and Chief Collaboration Officer of eXp Realty World Holdings. “Beyond the inherent advantages of agents compensation model, the company tech-enabled choices are more and more contributing to the company aggressive place by enabling the company to scale at a speedy tempo. We now have robust execution against our domestic progress strategy whereas continuing to launch new international markets and increasing our industrial brokerage business that lends properly to our general model.”

First Quarter 2021 Financial Results – Virtual Fireside Chat

The Company will host a virtual live chat and investor Q&A session with eXp Realty World Holdings Founder and CEO Glenn Sanford, CFO Jeff Whiteside, and President of U.S.A Development Dave Conord on Thursday, May 6, 2021, to discuss first quarter 2021 financial outcomes and up to date milestone progress. Greg Falesnik, CEO of MZ North America, will moderate the discussion. The investor Q&A is open to investors, present stockholders, and anybody considering learning extra on how eXp Realty World Holdings and its platform works. Date: Thursday, May 6, 2021 Time: 2 p.m. PDT/ 5 p.m. EDT Location: EXPI Campus. Be a part of at here Livestream: Here

About eXp World Holdings, Inc.

eXp Realty World Holdings, Inc. (Nasdaq: EXPI) is the holding company for eXp Realty, Virbela, and SUCCESS Enterprises. eXp Realty World Holdings and its global brokerage, eXp Realty, is one of the fastest-growing real estate tech companies globally with more than 53,000 agents in the USA, Canada, the UK, Australia, South Africa, India, Mexico, Portugal, France, Puerto Rico, Brazil, Italy, Hong Kong, and Colombia, and continues to scale internationally. As a publicly-traded company, eXp Realty offers real estate professionals the distinctive opportunity to earn fairness awards for production goals and contributions to general company progress. eXp Realty and its companies provide a full suite of brokerage and real estate tech options, together with its modern residential and industrial brokerage model, skilled services, collaborative tools and own growth. The cloud-based brokerage is powered by an immersive 3D platform that’s deeply social and collaborative, enabling agents to be more linked and productive.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Polkadot

Polkadot  WETH

WETH  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Official Trump

Official Trump  Bitget Token

Bitget Token  Uniswap

Uniswap  Pepe

Pepe  Wrapped eETH

Wrapped eETH  USDS

USDS  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Ethereum Classic

Ethereum Classic  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Render

Render  Dai

Dai  Bittensor

Bittensor  Algorand

Algorand  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance

Leave a Reply