Review of IG is a well-known multi-asset broker that is both publicly traded and regulated in a variety of jurisdictions across the world. To us, IG is the finest overall broker in 2022 because of its excellent customer service.

Due to their high degree of leverage, contracts for difference (CFDs) carry a significant danger of losing money quickly. When trading CFDs with this supplier, 75% of retail investor accounts lose money. Consider whether you understand how CFDs work and whether you can afford to incur the high risk of losing your money before you invest. No financial advice or investment recommendation should be construed as being provided in this article.

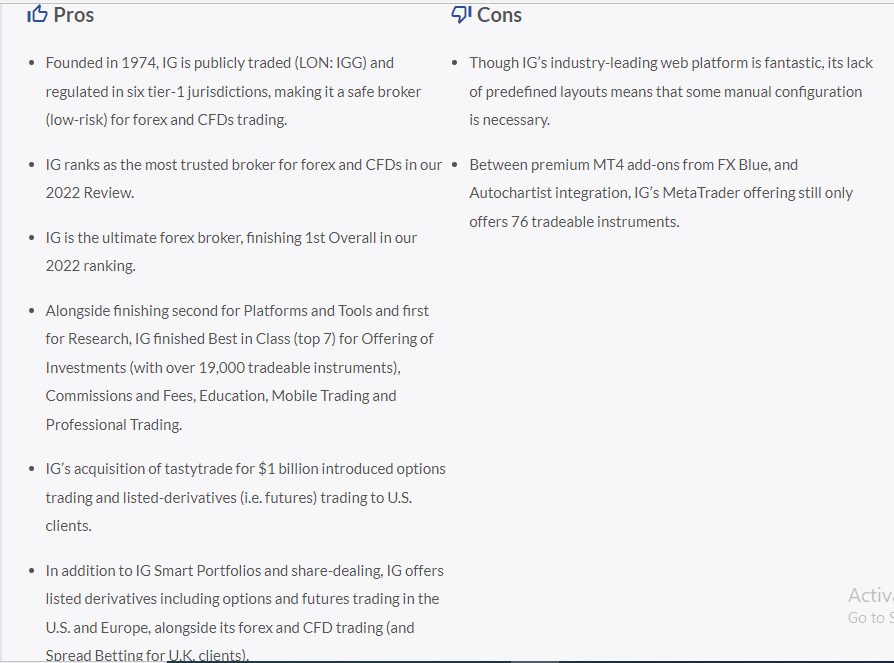

Trading and research tools of the highest caliber are included in the IG comprehensive trading package, as well as industry-leading education and a large selection of tradeable markets to choose from.

IG is a well-known multi-asset broker that is both publicly traded and regulated in a variety of jurisdictions across the world. To us, IG is the finest overall broker in 2022 because of its excellent customer service.

In All Summary

Is IG secure?

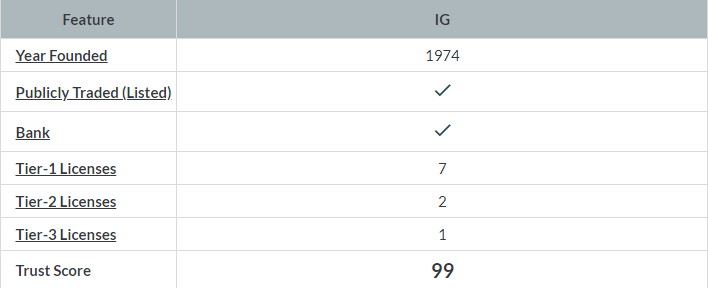

IG has a Trust Score of 99 out of 100. IG is a publicly traded company, it does operate a regulated bank, and it is authorized by seven tier-1 regulators (high trust), two tier-2 regulators (medium trust), and one tier-3 regulator (low trust). Regulation IG is regulated by: the Australian Securities & Investment Commission, the Japanese Financial Services Authority, Singapore’s MAS, Switzerland’s Financial Market Supervisory Authority (FINMA), the UK’s FCA, the NZ FMA, and the US Commodity Futures Trading Commission (CFTC). Trust Score explained.

Laws Comparison

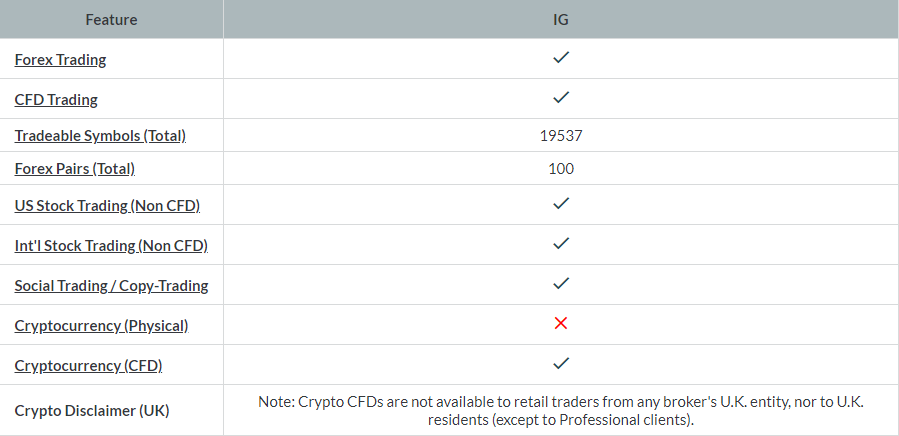

Offering of investment opportunities

Depending on which of IG’s regulatory agencies manages your account, the selection of available markets may change. Residents of the United States, the United Kingdom, New Zealand, and Japan must select their respective local IG organization.

In addition to nearly 20,000 CFDs, IG provides access to international stock exchanges via exchange-traded securities (non-CFDs) for residents of the United Kingdom (see our IG U.K. share dealing review), Germany, and Australia. In addition to currency options, IG provides exchange-traded Turbo warrants via Spectrum, its Multilateral Trading Facility (MTF) in Europe, and listed derivatives via tastytrade in the United States. Also available to qualifying clients is IG Bank in Switzerland.

Cryptocurrency: Cryptocurrency trading is available through CFDs at IG, however trading the underlying asset is not (e.g., buying Bitcoin). IG does not offer crypto futures to retail traders in the United Kingdom.

The table below provides a summary of the various investment packages accessible to IG customers.

Offerings of investments by IG:

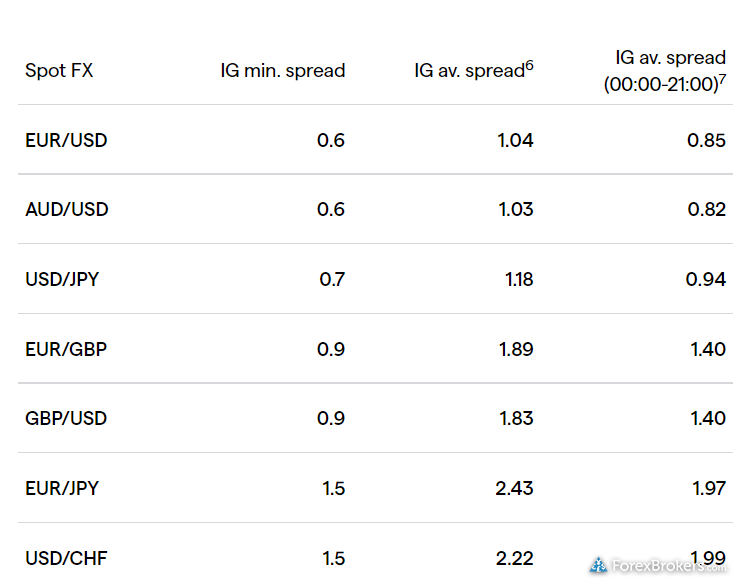

Commissions and service fees

traded. Because of its active trader pricing and massive order execution capabilities through its Forex Direct accounts, IG cannot be considered a bargain broker. Spreads on its main account are closer to the average for the industry in 2021, with spreads averaging 0.828 most of the time (23 hours a day) in September of that year.

CFD account average spreads: For both mini and standard-size contracts, the average spread during the main trading session (22 hours each day from 0000 to 2200 GMT) in September 2021 was 0.768 pips, which is slightly better than the industry average. Notably, as with most forex brokers, IG’s spreads during low-liquid times can be greater than usual, averaging 0.994 pips over the remaining hours of the trading day (2100 to 0000 GMT) in September 2021.

CFD account active trader rebates: IG’s three-tier active trader rebate program offers pricing savings to volume traders who qualify as professionals under EU regulations. In tier one, you can earn a 10 percent spread rebate if your monthly FX volume exceeds £50 million. The discount increases to as much as 20% if you trade above £300 million every month. In a different context, 20% of 0.76 pips is 0.17 pips, which would result in an all-in cost of just 0.60 pips – an extremely competitive spread.

DMA account (Forex Direct): The DMA account is an even better alternative than the active trader rebates on IG’s spread-only pricing for the most savvy traders wanting more significant reductions than those available in the CFD account. This commission-based solution, Forex Direct, gives traders access to the L2 Dealer platform via the DMA account. The DMA account just requires a minimum deposit of £1,000 and uses tiered pricing based on the trader’s trading volume from the previous month.

DMA account average spreads:

With average spreads of 0.165 on the EUR/USD for the 12 weeks ending March 19th, 2019, the all-in spread for traders who transact less than $100 million per month is 1.3 pips utilizing the base tier of $60 per million. Over 1.5 yards of trading (one yard = $1 billion in volume), the per-side commission drops to $10 per million ($20 round-turn), resulting in an effective spread of 0.365 pip – with the 2019 data as the reference point.

Forex Direct is a form of execution in which IG operates as an agency broker for interbank liquidity providers. Unlike IC Markets, FP Markets, and FOREX.com, IG does not add any additional spread and instead charges a commission on every deal.

Gallery

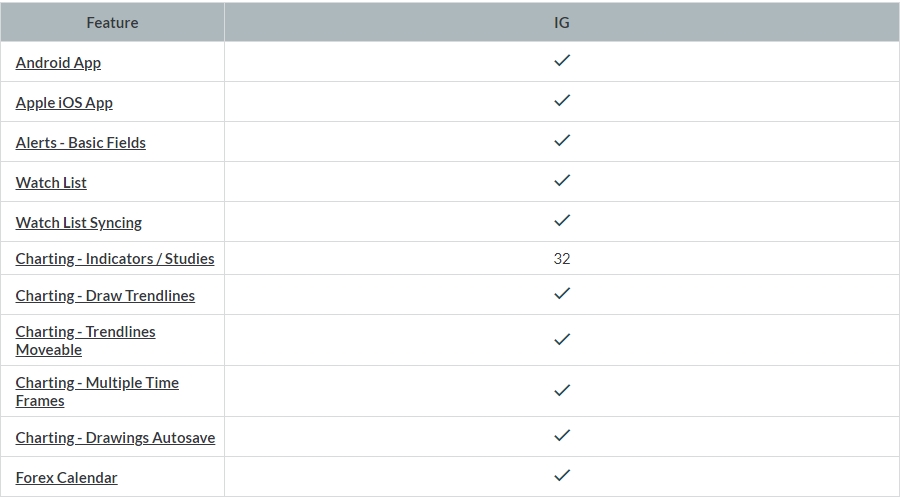

Apps for trading on mobile devices.

As one of the best in the business, IG has a mobile app that can please both novice and experienced traders. Due to IG’s app’s wide range of capabilities, the charts in the app are my favorite from all brokers.

a quick rundown of the most popular mobile applications: Both the popular MetaTrader 4 (MT4) and IG Trading mobile apps are available through IG (also known as IG Forex). In addition, IG Academy and IG Access are available for account security and education, respectively. However, neither of these apps allows for trading. In addition to a well-designed appearance, the IG Trading app is packed with features such as notifications, sentiment readings, and highly-advanced charting. Data comes from Reuters headlines and Autochartist signals as well as PIA First.

Ease of use: Instagram’s mobile app does a good job of mixing simplicity with depth. This software makes it easy to get Reuters’ integrated news headlines, or switch to market analysis or trading indications.

ALSO READ Bitcoins Market Reviews: Is Bitcoins Business Scam or Legit?

Grayscale Makes New Attempts To Turn Its GBTC Into An ETF

Is LUNA Foundation Currently Offering Purchased Bitcoin At A Discount?

Because there are no predefined watchlists or screeners, IG’s enormous product list is more difficult to sort through. Charts, on the other hand, are excellent on mobile and sync easily with the website. In other words, you can use a web-based chart template on a mobile app. However, unlike SaxoTraderGO from Saxo Bank, which syncs trend lines, there are no syncing watchlists on this platform. Even so, the Instagram mobile app has a lot of positive aspects.

IG’s vast product list can only be sifted through by hand because there are no predetermined watchlists or screeners. Charts, on the other hand, are excellent on mobile devices and sync effortlessly with the web. In other words, you can use a web-based chart template on a mobile app. Watchlists can be synced, but trend lines do not, unlike on SaxoTraderGO from Saxo Bank, sync. Even so, the Instagram mobile app has a lot going for it.

Charting: IG’s mobile app has 30 technical indicators, 20 drawing tools, and 16 time frames that can be chosen. There are five different types of charts, including tick charts, that can be used. It’s simple to set up charts, and moving between different time periods and zooming in and out is a breeze. The mobile app will not immediately sync any chart indicators that are added to the web platform (although they can be saved as presets). Still, the charts on IG Mobile were a joy to use.

IG Academy is a mobile app specifically designed for IG’s educational films.

Gallery

A mobile version of IG’s trading platform

Other platforms for trading

Investors of all skill levels can take use of IG’s wide range of trading platforms and tools.

The L2 Dealer DMA platform and the ProRealTime charting software platform are both available through IG, but my testing was limited to the company’s primary web platform. As with any good user experience, the focus is on ease of use, and the IG web-based platform does not disappoint in this regard. Open from any angle, these charts provide live market data as well the streaming bid/ask rates. There is a seemingly unlimited selection of research and trading tools, such as modules for integrated risk management. The default view is essentially empty, so you’ll want to spend some time customizing it. You may, however, save multiple layouts.

Charting: The IG platform’s default charts include additional features like the option to add up to four alerts to each of its 11 supported indicators. There are five different types of charts, and there is also a tick chart, which is a useful tool that not all brokers offer. That the zooming and resizing between time frames all felt very quick and seamless was also a big plus for me. With the chart and integrated trade ticket, you can see risk/reward ratios and set stop/limit orders with incredible precision.

There are a variety of specialized platforms offered through IG, including the MetaTrader4 (MT4) and L2 Dealer platforms, which allow investors to trade shares using Forex Direct and Direct Market Access (DMA). L2 Dealer, which requires a $1,000 minimum deposit, is a feasible choice for active traders because of its support for advanced algorithmic order types and because of the discounts given for active traders.

An unique third-party platform, ProRealTime, provides superior charting with approximately 100 indicators and assistance for automated trading techniques in the United Kingdom. If you don’t make at least four trades in a calendar year, ProRealTime charges you £30 per month. Even though the layout of ProRealTime is very flexible, my testing made me think that it could use a modern update. Modern snap grid layouts, for example, are better than floating windows since they’re less cluttered and easier to maintain. However, its charts were a joy to use, and I loved the automatic coloring of studies, which made them easier to read when incorporating numerous indicators into one chart.

Gallery

trading on the IG website

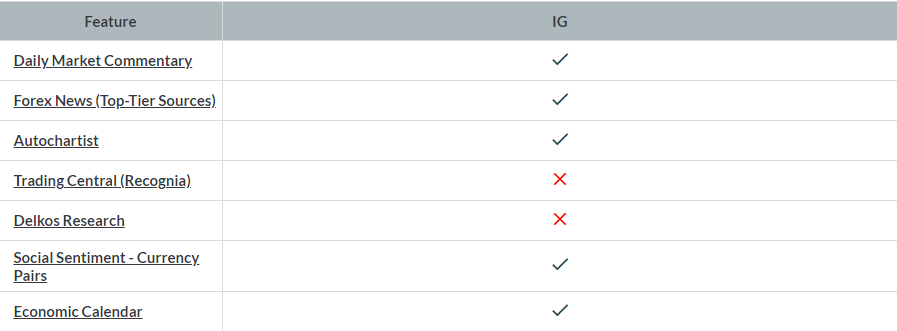

Research on the market

A wide range of high-quality market research is available from both internal and external sources at IG. Only TD Ameritrade (U.S. residents only) and Interactive Brokers can equal the sheer volume of content on IG’s platform, which includes in-house programming via IGTV.

The Week Ahead video and article series, as well as several daily blog updates with market analysis, are all part of IG’s research tools. These include streaming news and TV from Reuters, trading signals, and in-house broadcasting via IGTV.

CFDs on global equities, currency, and other asset classes can be screened using advanced technologies. IG’s new “Recommended News” section allows you to curate your feed depending on the characteristics of your account. The already excellent amount of research that is offered by IG is effectively doubled thanks to the addition of content from DailyFX.

Automatic pattern recognition and technical analysis: Autochartist and PIA First are integrated into IG’s platform, allowing traders to view trade signals created by automated pattern recognition and analysis. These trading ideas can be replicated in a hassle-free manner with the touch of a single button, which automatically populates the trade ticket window. In addition, IG publishes various articles and videos on a daily basis, which are accessible throughout the trading week.

DailyFX and the IG Community: IG is the company that powers DailyFX, a news website written in a blog format that offers IG clients daily articles and a variety of research tools. Over 60,000 members are connected through the social network IG Community, which was only recently introduced and is modeled after an advanced forum. Even if the content is the result of crowdsourcing, I still found it to be useful because IG selects the most relevant research papers by hand. In addition, there is a timeline that displays the activities of members (much like a social network) in the form of new memberships, following, and comments on threads.

Gallery

IG research:.

Education

As a pioneer in educational content, IG has an extensive library of video, written materials and multiple weekly seminars and tutorials from DailyFX to help traders learn the ropes. For those with more or less experience, you can find IG Academy’s instructional courses, which are divided into levels and include assessments such as tests and quizzes. With over 64,000 active members, IG’s robust social network provides a wide range of user-generated content.

Learning center: The website, as well as its YouTube channel and its service on DailyFX, all contain a variety of educational articles and videos. DailyFX provides a well-designed course that tracks students’ advancement and includes written materials, in addition to providing eight trading guidelines for beginners and five trading guides for advanced traders. Additionally, there are seven articles on risk management from Bollinger Bands, seventeen articles for beginners, and support for additional languages. Bollinger Bands also has instructional content.

IG Academy: IG Academy offers eight courses, each with almost a dozen chapters, grouped by level of experience. The coursework in these classes is designed to be an interactive experience and includes video material, lecture summaries, and multiple choice questions at various points. In addition, there is a final exam in which you are given a score based on how many questions you successfully answered.

Additionally, IG has its own in-house broadcasting with IGTV, which it offers in addition to its YouTube channels and other playlists. With weekly podcasts and webinars, IGTV is a wonderful instructional resource. The Technical Analysis Masterclass, for example, is a live presentation by IG professionals on several instructional themes. Even the webinars that have already happened are organized by how much experience you have, so it’s easy to find what you need quickly.

IG Community: As previously mentioned in the research part, IG curates content from the IG Community. There are instructive articles, and there are narratives, in which traders share their personal perspectives and their trading successes and mistakes, in the form of personal narratives.

In terms of educational offerings, IG has little space for improvement, given it is already the market leader in this area. It’s possible that integrating the IG Academy mobile app’s content into the main IG Trading app would simplify and improve access to the company’s educational resources. Including additional advanced content, whether in written or video form, would be beneficial as well.

Gallery

Education pertaining to IG:

Conclusions and musings

IG is an excellent option for retail FX and CFD traders who are looking for a reliable broker that provides excellent tools, research, and access to practically every worldwide market (over 19,500 tradeable assets).

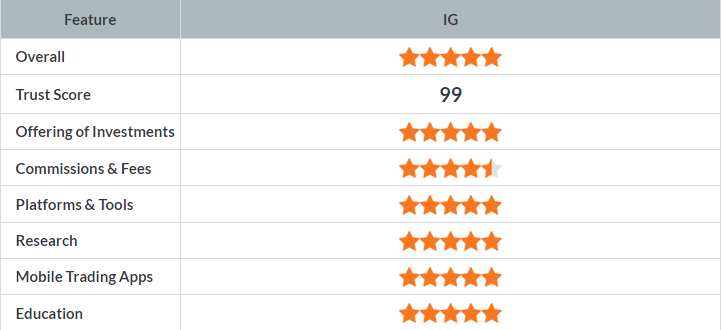

In 2022, IG came out on top in a number of areas, including Offering of Investments, Commissions and Fees, Platform and Tools, Research, Education, Mobile Trading, Professional Trading, Trust Score, and Overall. IG also received the highest possible score in each of these categories.

In conclusion, I believe that IG will prevail in 2022.

Is IG a reputable brokerage firm?

Absolutely, IG is a great broker, as evidenced by the fact that it holds the number one spot in practically all of the most important categories for traders.

In its capacity as an online broker, IG goes above and beyond to provide clients with a comprehensive experience that includes a variety of opportunities for investing in the financial markets. Its competitive advantages lie in its low trading fees, user-friendliness, variety of platforms and marketplaces, accessibility to educational materials, mobile applications, research, and trading tools.

Is it safe to keep my money with IG?

It is true that IG has more regulatory licenses than any other online broker that provides FX and CFD trading options. As a publicly traded corporation that has been in business for decades, IG is considered to be a safe place to keep customer assets, including cash money.

As of its most recent trading update, which took place at the beginning of 2021, IG holds your funds across a variety of banks and together provides services to over 191,000 active clients. IG’s market capitalization of around 3.19 billion pounds (as of May 12, 2021) makes it a safe choice when it comes to reducing your potential counterparty risk.

What is the bare minimum required to start trading with IG?

The minimum deposit required to open a trading account with IG can range anywhere from $250 or 300 euros (EUR), all the way up to 2,500 Swiss francs (CHF), depending on which IG company you choose to open the account with and the nation in where you were born.

For instance, customers of IG South Africa are required to make a minimum deposit of 4,000 South African rand (ZAR), whilst customers of IG Japan are required to make a minimum deposit of 35,000 Japanese yen (JPY). The minimum deposit required to open a live account with IG Australia is 450 Australian dollars (AUD), however in Singapore, it is only 400 Singapore dollars (SGD) (SGD).

About IG:

IG was established in 1974 and has since developed into a world-renowned leader in the field of online trading. The company was an early innovator in the provision of contracts for difference (CFDs) and spread betting. As of October 2021, the market capitalization of IG, a public company headquartered in London and listed on the London Stock Exchange’s FTSE 250 under the ticker symbol LON: IGG, was £3.539 billion.

IG has 2,034 employees and services over 313,300 active clients across the globe across its regulated organizations in the UK and internationally, according to its annual report for the financial year ending May 31, 2021. This report covers the period from May 31, 2020 to May 31, 2021. Look up further information on Wikipedia.

The 2022 Methodology Review

Disclaimer of Forex-Related Risks

Trading in securities exposes one to a significant amount of risk on a consistent basis. Due to the high level of risk associated with margin-based foreign currency trading, off-exchange derivatives and cryptocurrency, there is a potential impact on the price or liquidity of a currency or linked instrument due to factors such as leverage, creditworthiness, regulatory protection and market volatility. Not all approaches, tactics, or indicators in these items are guaranteed to be profitable or avoid losses.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  NEAR Protocol

NEAR Protocol  MANTRA

MANTRA  Aave

Aave  Official Trump

Official Trump  Ondo

Ondo  Internet Computer

Internet Computer  Monero

Monero  Aptos

Aptos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Cronos

Cronos  Dai

Dai  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB

Leave a Reply