The S&P 500 broke down with a spike in volume on June 13, 2022. This was followed by a weak rally up after the FOMC of the Fed pointed out the bearish situation. As the video at the bottom of this post explains, the price structure and market rotation sequence of the current market growth are similar to those of the 2008 global financial crisis.

Using the Wyckoff Method to Find the Bright Side

After a drop of more than 10 percent in 6 trading periods, the S&P 500 is in a vulnerable spot where a stock market crash could easily happen. Over the weekend, Bitcoin broke below the support at 20000. This meant that people were willing to take less risk heading into the coming week.

But there may be a silver lining to the looming stock market crash if you use the Wyckoff trading method to spot the signs of a possible short-term rally. Check out the chart below.

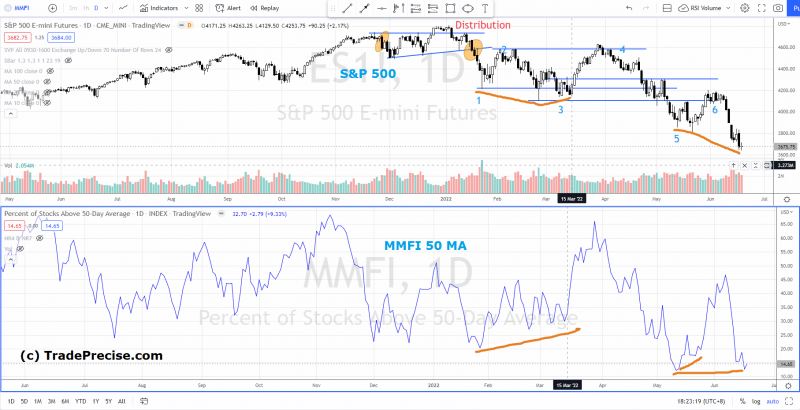

Since the short-term support at 4080 broke on June 9, 2022, the pullback has slowed down (shown in blue) and the number of pullbacks has decreased, which shows that the down momentum has run out.

A rally out of an oversold scenario may be possible for the S&P 500, which is currently testing the down channel’s oversold line. The bounce off the oversold line of the channel happened before on January 24, February 24, and May 20, 2022.

MORE ARTICLES

Stellantis will stop giving Canadians the COVID-19 vaccine on June 25.

See pictures of the 2023 Honda HR-V

According to the Level and Figure chart, the two value targets are 3900 and then 3650. For one month in May 2022, once the primary value target of 3900 was reached, the S&P 500 halted the down transfer. When the second price goal is reached at 3650, it gives S&P 500 a chance to try to rally, based on the technical details described above.

Even if the S&P 500 starts to go up, as shown by the green line, it’s important to watch how the price reacts at key levels like 3800 and the hole resistance zone near 3900. (annotated in pink line). Any failure along the way could mean that the rebound is over and that a sudden drop is about to start.

THE STORY GOES ON

Unless a short-term rebound occurs, a break below the current low at 3640 and a commitment below the oversold line of the down channel might trigger a capitulation, which could end in a stock market disaster similar to 2008’s situation as discussed in the video at the bottom of this post.

Bullish divergence between the S&P 500 and the market breadth

As the chart below shows, there was a bullish difference between the S&P 500 and the market breadth (the percentage of shares above their 50-day average).

There was a positive divergence (annotated in orange) between the end of January 2022 and the middle of March 2022, when the market breadth formed a better low while the S&P 500 formed a lower low. After the bullish divergence, the market went up in a big way.

An aid rally that targeted resistance near 4200 shaped a bullish divergence between 12 and 20 May 2022 as well.

From Could until now, a possible bullish divergence has been building up. If the S&P 500 went up a lot, it would be the third profitable bullish divergence.

Comparing the crash of the stock market in 2022 and 2008

When the silver lining fails along the way and even at the start, the S&P 500 is likely to go into market crash mode, just like the global financial crisis in 2008.

Watch the video below to see how the price structure and the market rotation sequence of the 2008 stock market crash are similar.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Chainlink

Chainlink  Polkadot

Polkadot  Stellar

Stellar  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Hedera

Hedera  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bonk

Bonk  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  dogwifhat

dogwifhat  Arbitrum

Arbitrum  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB

Leave a Reply