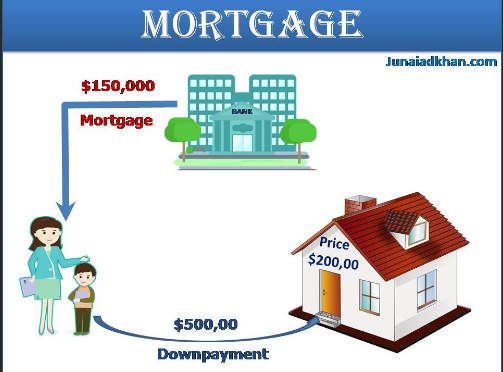

Let’s look at what happens when you refinance your mortgage so you know what to expect.

Your home is a financial asset.

One way to use your home to make that investment work for you is to refinance. Refinancing can be done for a variety of reasons, including obtaining additional funds from your house, reducing your monthly payment, and decreasing the length of your loan.

How does a house get refinanced?

When you refinance your mortgage, you’re basically trading in your old mortgage for a new one, which often has a different interest rate and a different principal. As a result, you just have to make one payment per month because your lender will utilize the newer mortgage to pay down the older one.

The reasons for refinancing one’s property might be several. You can use your home’s equity with a cash-out refinance, or you can use a rate-and-term refinance to get a better interest rate and/or lower monthly payment. Refinancing can also be utilized to get rid of a co-borrower from a mortgage, which is common in divorce cases. Lastly, you can put someone else on the mortgage.

How does it work to refinance a home?

Most of the time, the process of refinancing is easier than buying a home, even though it has many of the same steps. It’s difficult to say exactly how long it will take to refinance your home, but it’s usually between 30 and 45 days on average.

Let’s look more closely at what happens when you refinance.

Applying

This procedure begins with an examination of the various refinance options available to you in order to select the one that best suits your needs. Refinancing requires the same information you provided to a previous lender when purchasing a house. They’ll look at your income, assets, debts, and credit score to see if you meet the requirements for refinancing and can pay back the loan.

Some of the things your lender might ask for are:

- The last two pay stubs

- The last two W-2s

- The last two bank statements

If you are married and live in a state where property is shared, your lender may also need documents from your spouse (regardless of whether your spouse is on the loan). If you work for yourself, you might be asked for more proof of your income. It’s also a good idea to save a copy of your most recent tax returns.

You are not required to refinance with the financial institution that you now have. When you switch lenders, the new lender pays off your previous loan and ends your business relationship with the old one. Shop around and evaluate the current prices, availability and customer satisfaction scores of each lender without fear.

Getting your interest rate locked in

Your interest rate may be locked so that it does not change until the loan is closed if you are authorized and then given the opportunity to lock it in.

Rate locks can last between 15 and 60 days. The rate lock period depends on a few things, like where you live, the type of loan you have, and who your lender is. Choosing to lock for a shorter time period may also result in a better rate, as the lender does not have to hedge against the market for as long. But be careful: if your loan doesn’t close by the end of the lock period, you may have to pay to extend the rate lock.

You might also be able to “float” your rate, which means that you don’t have to lock it in before getting the loan. You might be able to get a lower rate with this feature, but you also run the risk of getting a higher rate. With a float-down option, you may be able to get the best of both worlds, but if you’re happy with the rates when you apply, it’s usually best to go ahead and lock your rate.

Underwriting

Your lender will start the underwriting process as soon as you send in your application. You’re mortgage lender verifies and confirms the accuracy of all of your given financial information during the underwriting process.

Like when you bought your home, your lender will check the details of the property. This step includes getting an appraisal to find out how much the home is worth. The refinance appraisal is a very important step because it tells you what options you have.

For example, if you want to refinance to get cash out, the value of your home will determine how much money you can get. If you want to lower your mortgage payment, the value could affect whether or not you have enough home equity to get rid of private mortgage insurance or qualify for a certain loan option.

Home Appraisal

Before you refinance, you must get an appraisal, just like when you bought your home. The appraisal is ordered by your lender, the appraiser comes to your home, and you get an estimate of how much your home is worth.

Prepare your home for the appraisal by giving it its finest appearance. To make a favorable impression, clean up and do any minor repairs. You should also make a list of the improvements you’ve made to the house since you’ve owned it.

The underwriting is complete if the home’s value is equal to or greater than the amount of money you wish to refinance. Your lender will get in touch with you to talk about the closing.

Your estimate may be off by a large margin. You have the option of reducing the amount of money you want to save by refinancing or canceling your application altogether. Cash-in refinances are another option, in which you bring money to the table to get better terms than what you’re now getting.

Your new loan closing

When your loan’s underwriting and appraisal processes have been completed, it’s time to finalize the transaction. A Closing Disclosure is a document that your lender will send you a few days before closing. That’s where you’ll find all the final numbers for your loan.

A home purchase closing takes longer than a refinance closing. At the closing, the people on the loan and the title, as well as someone from the lender or title company, are present.

During the closing, you’ll go over the terms of the loan and sign the loan papers. This is the time when you will pay any non-financed closing charges. After the closing, you will be given the funds that are owed to you by your lender. This may occur, for instance, if you are doing a cash-out refinance.

You have a few days after closing on your loan before you’re locked in. Even if you need to cancel your refinance because of unforeseen circumstances, you have a 3-day grace period during which you can do so.

4 Reasons You Should Refinance Your Mortgage

Refinancing your mortgage could be advantageous for a variety of reasons, as previously discussed. Let’s look at a few of the most important ones.

1. Change how long your loan lasts

To save money on interest, many consumers refinance their loans. Even if you started with a 30-year loan, you may suddenly have the ability to make a greater monthly payment. In order to save money on interest, you may want to consider refinancing to a 15-year term.

You can also extend the length of your loan to pay less each month.

2. Lower your rate of interest

Interest rates change all the time. If the rates on your loan are better now than when you got it, you might want to refinance. If you lower your interest rate, you may be able to pay less each month and pay less interest over the life of your loan.

3. Change the type of your loan

There are a lot of ways in which a different kind of loan could help you. You may have originally gotten an ARM to save money on interest, but now that rates are low, you’d prefer to switch to a fixed-rate mortgage.

Maybe you now have enough equity in your home to switch from an FHA loan to a regular loan and stop paying private mortgage insurance.

4. Get Cash from Your Equity

It’s possible to borrow more money than you owe on your home in order to get the money back. If the value of your home has gone up, you may have enough equity to get cash to make repairs, pay off debt, or pay for other things. When you borrow money from your home, the interest rate is much lower than with other types of loans. Taxes can be affected by a cash-out refinance, though.

FAQs on Refinancing

Read the common questions homeowners have about refinancing their mortgage loans to learn more about the process and get more mortgage refinance tips.

How much does it cost to get a new loan?

The total cost of refinancing depends on a number of things, like how much your home is worth and who your lender is. You should expect to pay 2–6% of the total amount of your loan.

Because of the elimination of the adverse market refinance fee, you may not have to pay those fees out of pocket when you refinance.

In some cases, you can get a refinance with no closing costs, so you don’t have to bring any money. Avoid paying a higher interest rate because of the closing costs, which will be paid back over time.

When should I get a new loan for my house?

When deciding if you should refinance, there are a lot of things to think about. Think about the market trends (like the current interest rates) and your own financial health (especially your credit score). After taking into account the costs of refinancing, it’s a good idea to use a mortgage refinance calculator to figure out your break-even point.

You also need to be familiar with the differences between refinancing and other alternatives pertaining to mortgages, such as loan modifications and second mortgages. The main difference between a refinance and a loan modification is that a refinance gives you a new mortgage while a loan modification changes your current terms.

Getting a second mortgage and refinancing are two different things. The new mortgage you acquire from refinancing replaces the old one, which is an essential distinction. Before you decide what to do, think about what works best for you.

It’s important to remember that you should only think about a modification if you can’t get a refinance and need long-term help with your payments. Modification usually has a big effect on your credit score in a bad way.

How soon can I refinance after I close?

A lot will depend on the kind of loan you’re getting and who is investing in it. It could be as short as 30 days or as long as 6 or 12 months.

The number of times you can refinance is determined by the amount of equity you’ve built up and the current balance of your mortgage.

How will my credit score change if I refinance my home?

When a homeowner wants to refinance their mortgage, the lender does a hard inquiry and checks the borrower’s credit report. This will lower your credit score for a short time, but only for a short time. After a few months, your credit score can get better as long as you don’t get any more credit cards and keep paying off any debts you have.

Refinancing can make your home work better for you.

You can use your home’s equity to help you save money by refinancing when the timing is appropriate.’ To save money in the long run, you can change the length of your loan, get a better interest rate, or switch the type of loan you have. Or, you can cash out the equity in your home and use the money for whatever you need.

Get ready to refinance that debt. Refinance with Rocket Mortgage® today to see what your alternatives are and to lock in a low rate. You can also call (833) 326-6018 to start the process.

MORE ARTICLES

Meta Files is launching Meta Pay, a cryptocurrency payment service.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Polkadot

Polkadot  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  USDS

USDS  Ethena USDe

Ethena USDe  Pepe

Pepe  NEAR Protocol

NEAR Protocol  MANTRA

MANTRA  Aave

Aave  Official Trump

Official Trump  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Monero

Monero  Mantle

Mantle  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Cronos

Cronos  Dai

Dai  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB

Leave a Reply