The post Bitcoin Miners Carry On With Their Dumping! Will the Price of Bitcoin Continue to Suffer? appeared initially on Coinpedia – Fintech & Cryptocurrency News Media | Crypto Guide.

The impending Ethereum Merge is currently the primary focus of the cryptocurrency market, whereas Bitcoin miners appear to be bracing themselves for a gloomy future. It is anticipated that the Ethereum Merge will initiate a bullish trend in the cryptocurrency market. Nevertheless, there are market participants who do not believe that the price of Ethereum (ETH) will rise in the period of approximately six months following the Integrate.

The data suggest that the reserves held by Bitcoin miners have maintained their historical downward trend, which may suggest that programmers have been surrendering their coins. According to a statement made by an economist in a post on CryptoQuant, BTC miner stockpiles have been shifting in a downward direction as of late, which may result in a decrease in the price of the cryptocurrency. A measure that is known as “miner reserves” represents the total amount of Bitcoin that is currently held in all wallets belonging to miners.

When the quantity of this indicator goes up, it shows that miners are now adding more money to their wallets, which is a positive sign. When a sequence like this continues for an extended period of time, it may be an indication that these network participating nodes are building up their holdings, which is bullish for the value of BTC.

A decrease in the index, on the other hand, is consistent with the idea that programmers are now transferring coins from their reserves. The fact that miners frequently sell their Bitcoin contributes to the formation of this trend, which may be bad for the cryptocurrency.

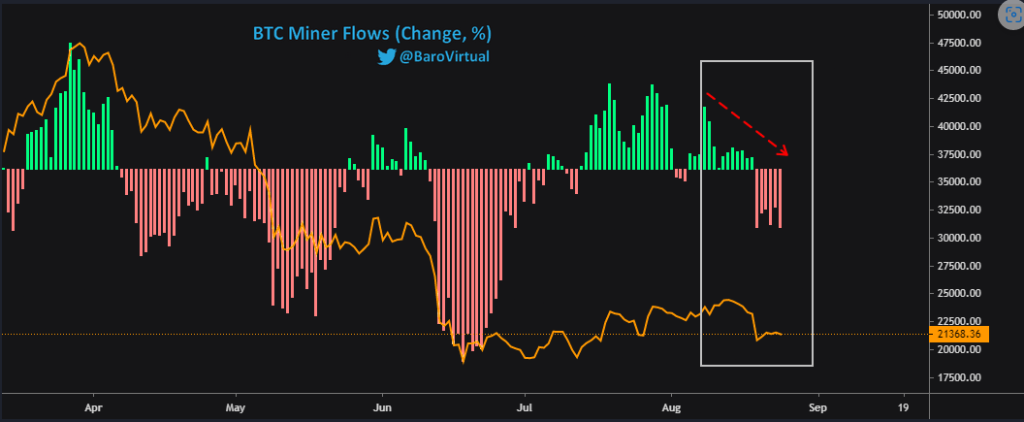

The following is a graph that illustrates the progression of Bitcoin miner net flow of water over the past few months. This is a statistic that tracks the percentage changes in the total miner deposits, and it looks like this:

If the numbers are positive, it indicates that the reserves are growing, however if they are negative, it indicates that the stockpiles are shrinking. As can be seen in the chart that is located above, the quantity of this BTC metric was higher than zero earlier in the month; but, as of late, it has dropped to a value that is lower than zero.

It is possible that this is an evidence that these miners have been unloading as of late. The data presented in the chart demonstrates that a decline in the price of BTC has occurred whenever an adverse adjustment has been made to the reserve over the past few months.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  Polkadot

Polkadot  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Bitget Token

Bitget Token  Official Trump

Official Trump  Uniswap

Uniswap  Pepe

Pepe  Wrapped eETH

Wrapped eETH  USDS

USDS  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Monero

Monero  Cronos

Cronos  Mantle

Mantle  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Dai

Dai  Algorand

Algorand  Bittensor

Bittensor  MANTRA

MANTRA

Leave a Reply